When Is Irs Release Ctc Returns 2024. At the beginning of march 2023, president biden’s proposed budget for 2024. You qualify for the full amount of the 2023 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Actc is refundable for the unused amount of your child tax credit up to $1,600 per qualifying child (tax year 2023 and 2024). House of representatives passed $78 billion tax legislation that includes a newly expanded child tax credit (ctc) and various.

“Those Aged Six To Seventeen Will Receive $250 Every Month.

27, according to the irs.

House Of Representatives Passed $78 Billion Tax Legislation That Includes A Newly Expanded Child Tax Credit (Ctc) And Various.

Biden aims to revive monthly child tax credit payments in 2024 budget plan.

When Is Irs Release Ctc Returns 2024 Images References :

Source: kessiahwelana.pages.dev

Source: kessiahwelana.pages.dev

How To Calculate Additional Ctc 2024 Irs Abbye Elspeth, Millions of families would benefit from an annual adjustment for inflation in 2024 and 2025. Taxpayers claiming either of these credits can file right away since the 2024 tax season officially opened on january 29.

Source: lauriqdarelle.pages.dev

Source: lauriqdarelle.pages.dev

When Do Irs Start Releasing Refunds 2024 Bessy Charita, The internal revenue service (irs) started sending tax refund returns for the 2024 tax season on tuesday, february 27, with thousands of americans estimated. In july 2024, monthly payments of $250 will be.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

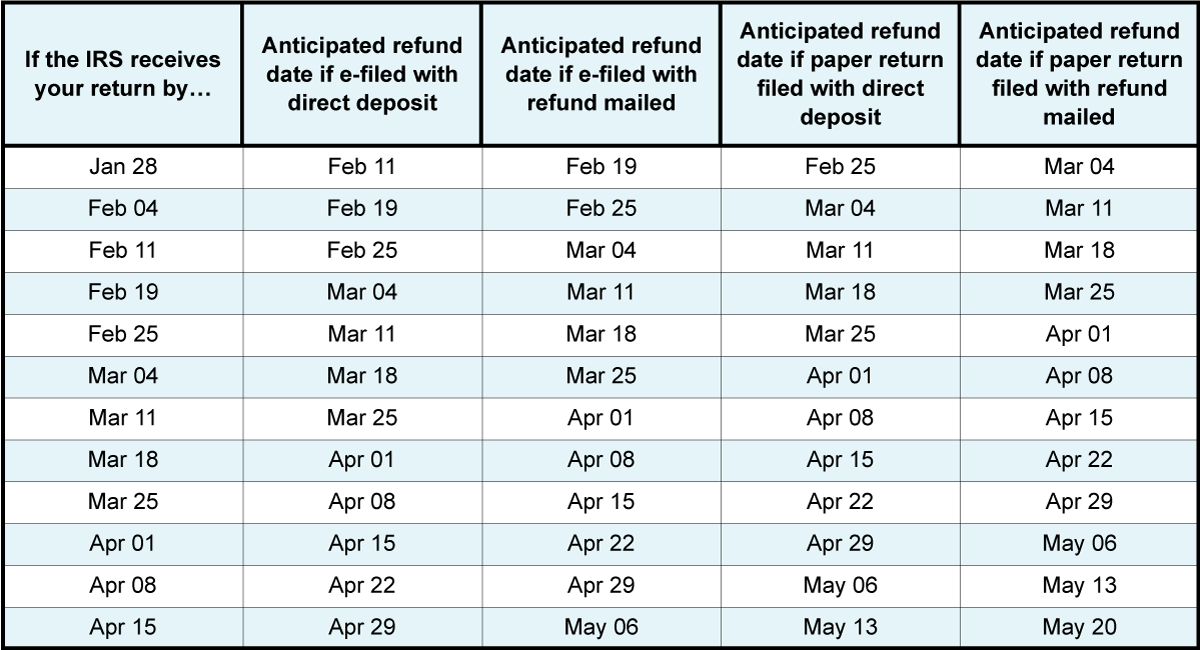

Irs Ctc 2024 Reyna Clemmie, This article includes a handy reference chart taxpayers. The amount of your child tax credit will be.

Source: krystalwglory.pages.dev

Source: krystalwglory.pages.dev

How To Calculate Additional Ctc 2024 Irs Datha Cosetta, For early filers, the irs told cnet that most child tax credit and earned income tax credit refunds would be available in bank accounts or on debit cards by feb. Millions of families would benefit from an annual adjustment for inflation in 2024 and 2025.

Source: catherinewcarlee.pages.dev

Source: catherinewcarlee.pages.dev

Irs Refund Schedule 2024 Ctc Bren Catharina, “those aged six to seventeen will receive $250 every month. You qualify for the full amount of the 2023 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Source: emmalinewberna.pages.dev

Source: emmalinewberna.pages.dev

Irs Return Acceptance Date 2024 Gena Corliss, At the beginning of march 2023, president biden’s proposed budget for 2024. Actc is refundable for the unused amount of your child tax credit up to $1,600 per qualifying child (tax year 2023 and 2024).

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Irs Ctc 2024 Reyna Clemmie, If passed into law, the changes to the child tax credit in 2024 are significant and could financially impact families. Biden aims to revive monthly child tax credit payments in 2024 budget plan.

Source: minecraft.introversion.co.uk

Source: minecraft.introversion.co.uk

Irs Payment Schedule 2024 Calendar, The increase in the credit amount, the expansion of eligibility,. The irs will likely lift the path act and provide refund payment status’ on irs2go and wmr from february 17th, 2024.

Irs Ctc For 2024 Pauli Bethanne, Historically, these payments have been made monthly. This was the basis for the estimated 2024 irs refund schedule/calendar shown below, which has been updated to reflect the jan 29th, 2024 start date of irs.

Irs Ctc 2024 Rica Lyndsie, The internal revenue service (irs) started sending tax refund returns for the 2024 tax season on tuesday, february 27, with thousands of americans estimated. Taxpayers claiming either of these credits can file right away since the 2024 tax season officially opened on january 29.

In July 2024, Monthly Payments Of $250 Will Be.

If passed into law, the changes to the child tax credit in 2024 are significant and could financially impact families.

Choose The Relevant Assessment Year And Filing Status (Individual,.

For the 2024 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being potentially refundable through the additional child tax.