Salary Threshold For Exempt 2024 Wa State

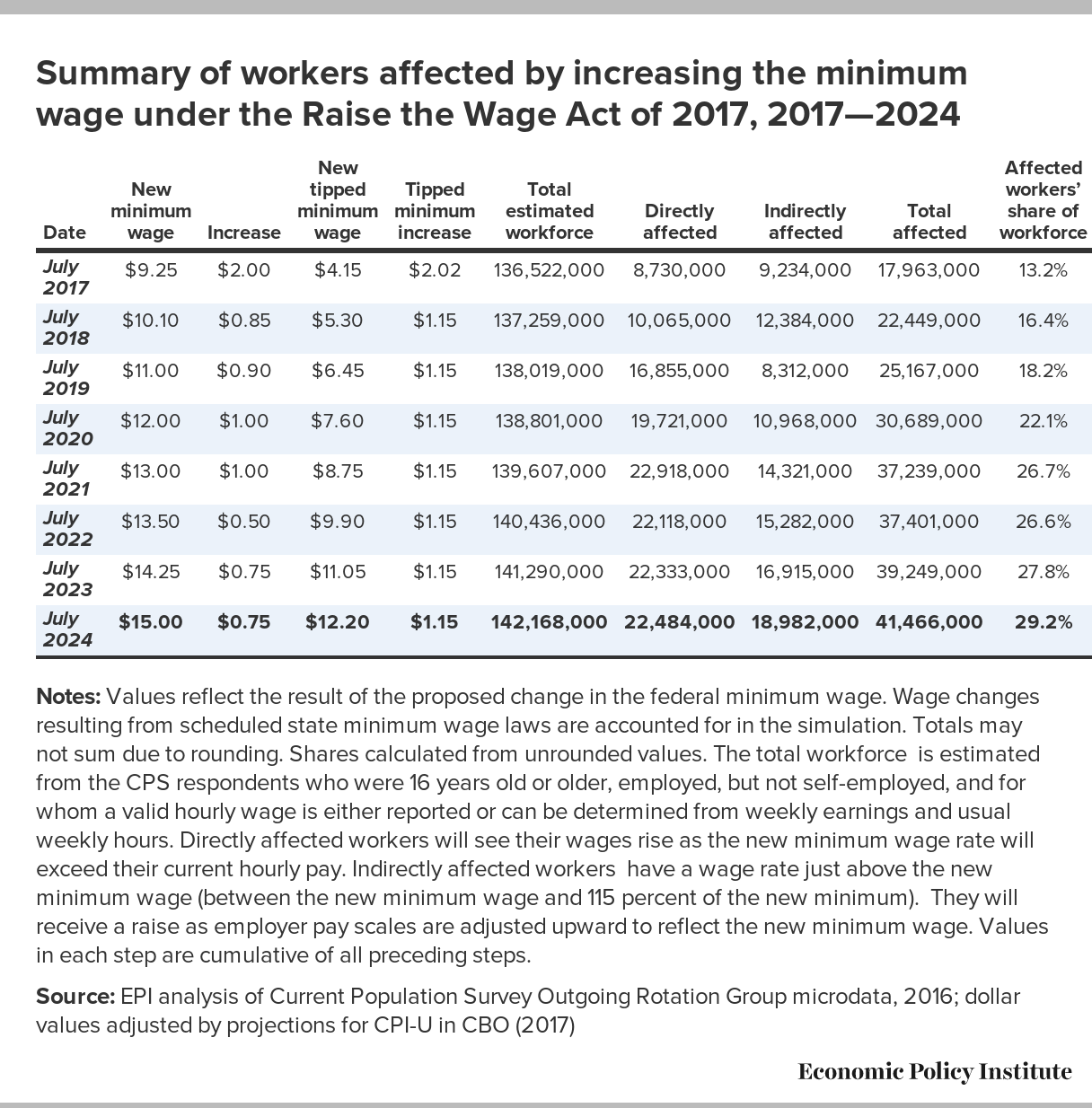

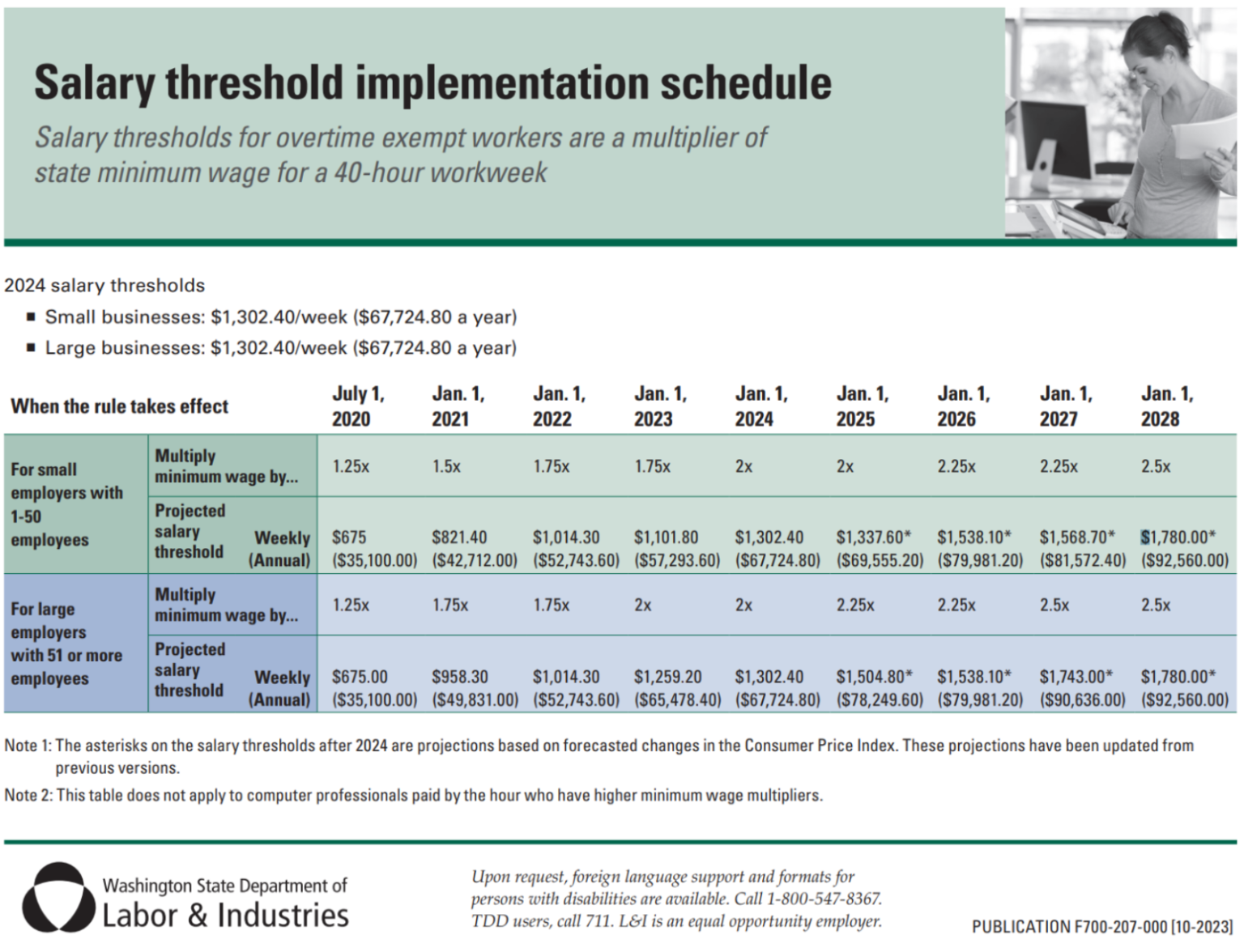

For january 1, 2024, the minimum salary threshold to satisfy the law’s “executive, administrative and professional” exemption will be $67,724.80 per year ($1,2302.40 per. The threshold salary requirement for exempt employees is determined through a calculation based upon minimum wage.

On april 23, 2024, the u.s. Salary employees must earn this amount to be exempt from overtime pay.

This Change Impacts How Much Executive, Administrative, And Professional Workers Plus Computer Professionals And Outside Salespeople Must Earn In Salary To Be.

Washington employers should begin following the new washington rules because the state threshold will become more favorable to employees at $821.40 a.

Salary Employees Must Earn This Amount To Be Exempt From Overtime Pay.

For both large (more than 50 employees) and small.

Images References :

Source: karleenwberri.pages.dev

Source: karleenwberri.pages.dev

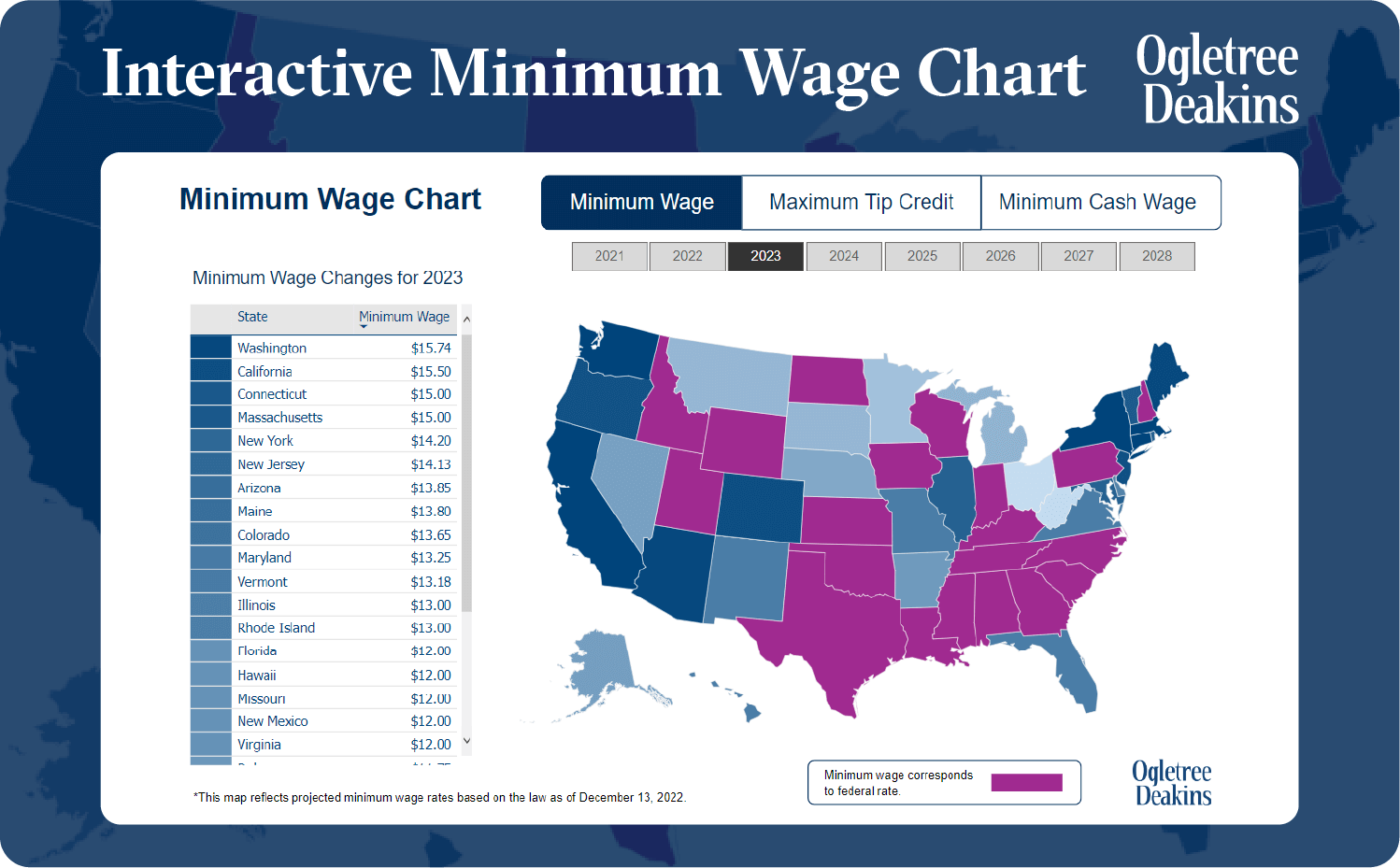

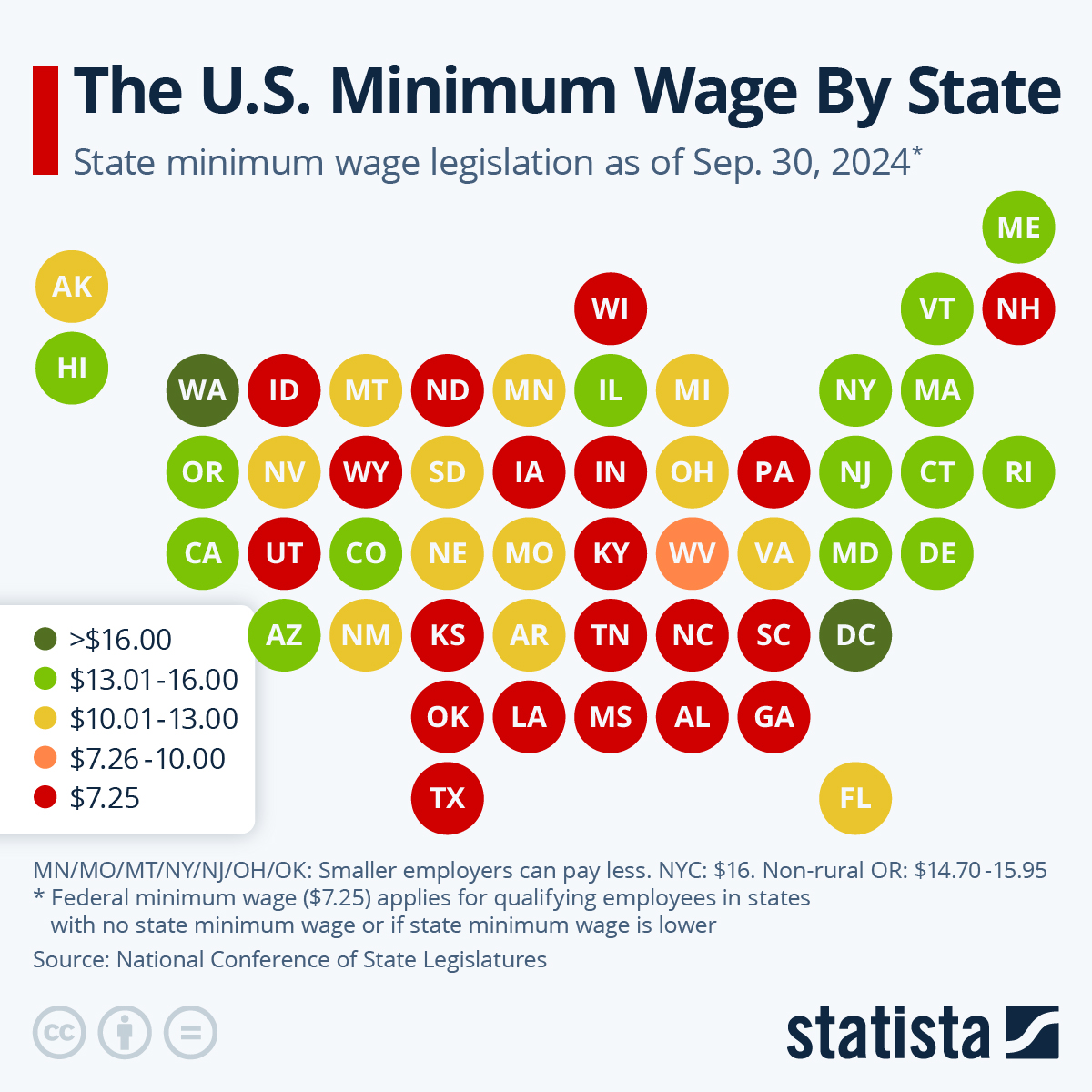

Minimum Wage 2024 Washington State Calculator Prudy Kimberley, The list includes some special districts in states but does not include. In accordance with washington state's salary threshold implementation schedule, the salary threshold for overtime exempt workers is twice the annual minimum.

Source: muffinwcarlyn.pages.dev

Source: muffinwcarlyn.pages.dev

Washington Minimum Wage 2024 Exempt Employer Amalle Britteny, The washington state labor and industries (l&i) announced the minimum salary an employee must earn to be exempt from overtime. Beginning july 1, 2024, the threshold will increase to.

Source: lotteqwandis.pages.dev

Source: lotteqwandis.pages.dev

Washington State Minimum Exempt Salary 2024 Eadie Gusella, The following is a comprehensive list of the 2024 exempt status salary threshold by state. For both large (more than 50 employees) and small.

Minimum Exempt Salary Washington State 2024 Reyna Charmian, Beginning july 1, 2024, the threshold will increase to. Washington employers should begin following the new washington rules because the state threshold will become more favorable to employees at $821.40 a.

Source: leliaqingaborg.pages.dev

Source: leliaqingaborg.pages.dev

Proposed Exempt Salary Threshold 2024 Briny Coletta, This change impacts how much executive, administrative, and professional workers plus computer professionals and outside salespeople must earn in salary to be. The minimum salary required for a bona fide eap employee to be exempt would increase in two phases.

Source: ivettqsharleen.pages.dev

Source: ivettqsharleen.pages.dev

Exempt Salary Threshold By State 2024 Gusta Katrina, In addition, the rule will adjust the threshold for highly compensated. The minimum salary required for exemption is two times the state minimum wage for the first 40 hours of employment each week.

Source: reverbpeople.com

Source: reverbpeople.com

Compliance Alert WA State Salary Threshold for 2024 Reverb, Beginning july 1, 2024, the threshold will increase to. This change impacts how much executive, administrative, and professional workers plus computer professionals and outside salespeople must earn in salary to be.

Source: ronnaqtoinette.pages.dev

Source: ronnaqtoinette.pages.dev

Exempt Salary Threshold 2024 Joya Rubina, The washington state labor and industries (l&i) announced the minimum salary an employee must earn to be exempt from overtime. The threshold salary requirement for exempt employees is determined through a calculation based upon minimum wage.

Exempt Salary Threshold 2024 Joya Rubina, As a result of a change in the. For january 1, 2024, the minimum salary threshold to satisfy the law’s “executive, administrative and professional” exemption will be $67,724.80 per year ($1,2302.40 per.

Source: jenaqaugusta.pages.dev

Source: jenaqaugusta.pages.dev

New Exempt Salary Threshold 2024 Helge Fernande, In accordance with washington state's salary threshold implementation schedule, the salary threshold for overtime exempt workers is twice the annual minimum. The minimum annual salary threshold for exempt employees statewide will also rise on january 1, 2024.

In Accordance With Washington State's Salary Threshold Implementation Schedule, The Salary Threshold For Overtime Exempt Workers Is Twice The Annual Minimum.

The washington state overtime threshold for exempt jobs as of january 1, 2024, is set by state rule at 2 times the state minimum wage and will be $1,302.40 per.

Salary Employees Must Earn This Amount To Be Exempt From Overtime Pay.

The minimum annual salary threshold for exempt employees statewide will also rise on january 1, 2024.